29 November 2022.- As a result of Delegated Regulation 2022/1288, the European regulation requiring CII fund managers (SGIIC) with funds that promote sustainability, or that target sustainable investments, to register a sustainability annex with the CNMV, comes into force in January 2023.

The CNMV recently warned in a press release that this obligation "may require a significant adaptation effort on the part of fund managers". In addition, at the same time the change of the PRIIPS Key Investor Information Document (KID) will also come into force. For this reason, the regulator has launched a simplified procedure for registering standardised reporting templates for sustainable products and also for traditional funds that want to transform into sustainable funds. This opens up an opportunity for firms that want to transform their portfolio.

The industry is concerned about the increase in regulatory obligations, but also believes that sustainability could be a catalyst for Spanish customers to make the leap from saver to investor. This was discussed during the 25th edition of the FundsPeople Legal Debate.

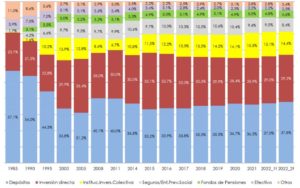

"Perhaps the sustainability component can encourage the mass of savers who have not yet taken the step to become investors to do so. It is clear that this type of customer is not won over solely on the expectation of financial returns, because growth has continued even with zero interest rates, but perhaps they are attracted by non-financial criteria", points out Elisa Ricón, CEO of Inverco. According to Inverco's quarterly report on the financial savings of Spanish households, deposits account for almost 38% of total household financial savings. More than one trillion euros.

Evolution of the structure of household financial savings

Source: Inverco, data as at June 2022

An opinion shared by Leovigildo Domene, Director at Deloitte Legal, who believes that "this measure will help the investor to be part of this sustainable transition, although the sector still has some challenges ahead. On the one hand, those derived from the implementation itself in the absence of a comprehensive regulatory framework; and, on the other hand, how to match investors' expectations with the reality of what is on offer in the market, as some of them may not be so accustomed to the characteristics of these funds", he explains.

For experts, the basic problem is none other than the lack of financial literacy in Spain. For this reason, although environmental, social and governance criteria "can and will be a way of attracting Spanish savers, there is still some way to go before this objective becomes a reality", says Alfredo Oñoro, Director of Regulatory Compliance at Cecabank.

For now, both regulators in Spain and in Europe have set ESG as a strategic objective and regulations have been approved to materialise this objective. Indeed, "the regulations are new, it takes time to adapt and the reality is that we are all learning, both the fund managers and the supervisor", recalls Ana Martínez Pina, Head of Regulatory Finance and Insurance at Gómez, Acebo & Pombo.

Some criticism

There was also room for criticism of the green trend that has taken hold in the markets: "There is an attempt by the European Union to turn everything green. This collides with reality, because we also need the other projects", recalls Salvador Ruiz, partner at Allen & Overy. He believes that "we are establishing an extraordinarily complex regulatory regime based on policy objectives that may vary".

He is not the only one critical of the increased regulatory burden. Ricón believes that "it is again about dedicating time and effort, which is the scarcest resource, to comply with a standard, but not to build value", he warns. In this regard, Oñoro calls for clear and homogeneous supervisory criteria: "A very complex scenario has been created and, although we all share the objectives, the rules need to be further clarified so that they can be applied uniformly by the industry".