The bank reaches a solvency rate CET1 of 35.3%, between the highest ones of the Spanish financial system

The rating agency Moody’s has gone up the rating of Cecabank to Baa1, when considering positively perspectives of the model of business of the company

Cecabank maintains its leading position in Securities Services, having reached in 2023 its all-time record in low assets custody (310,000 million euros) and deposited assets (more than 224,000 million euros)

Throughout the year, the company has processed more than 1,450 million transactions with cards and more than 800 million operations with account, including 156 million transactions Bizum from client to client, consolidating, as well as performance benchmark in fee-paying solutions

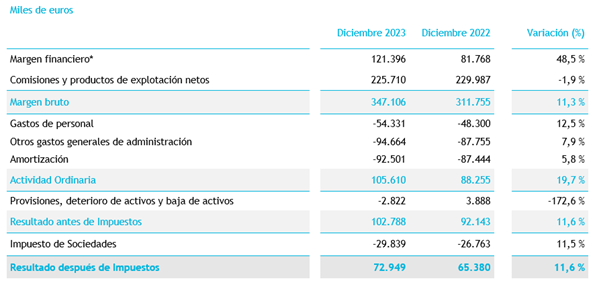

Cecabank, the Spanish wholesale bank offering specialised services in securities, treasury management and payments, held its annual general meeting today, where it presented its results for FY 2023. The company has closed the financial year with a net result of 72.9 million euros, which means an increase of 11.6% when dealing with the year 2022.

The gross income also has increased 11.3% with respect to 2022, reaching the 347 million euros, the highest detail from the creation of the bank in 2012.

Cecabank maintains one of the higher solvency rates of our country's financial system. Specifically, at the close of the financial year 2023, the ratio CET1 was placed at 35.3%, considerably higher than the legal requirements. Similarly, the rating agency Moody’s went up yesterday the rating (of the long-term deposits) of Cecabank to Baa1 from Baa2, when considering that favourable operating conditions for the Spanish banks will strengthen the model of business of the financial services company as supplier wholesalers.

For Cecabank, 2023 has been a year's profound transformation with regard to technological infrastructure with the commitment of following offering the best service. Within the framework of the Plan of Technology 2022-2025, aimed at promote the business, generate efficiency and promote the operational resilience, the company last year acquired two servers mainframe IBM z16, equipped of advanced and skills cryptography quantum.

In parallel, Cecabank maintains a steady commitment for the accompaniment to its clients with regard to sustainability. For two years, the company is neutral in carbon in own operations (extent 1+2) and pioneer in the calculation of the carbon footprint of its portfolio of investment. The quality survey to clients reflects an overall satisfaction of 8.7 on 10, exceeding the detail of the previous year.

Income statement of Cecabank

In José María's words Méndez, chief executive officer of Cecabank: “The results in the financial year 2023 consolidate to Cecabank as an essential infrastructure of the Spanish financial system. Our business model, based on the financial and technological provision of services to the market operators, has been strengthened to continue offering to our clients the best portfolio of solutions B2B, flexible, innovators and adapted to the rhythm of the industry's evolution, to new regulatory frameworks and to the transformation of the company”.

Cecabank, the success of a model of business sinérgico

Through a model based in three lines of business sinérgicas between yes, Cecabank is today a leading supplier in provision of services of securities, treasury and payments to credit institutions, collective investment institution' management companies, companies of venture capital, insurance companies and companies of investment services, among others.

As a company that includes all the services of negotiable securities and financial instruments postcontracting , such as depositary, record-custody, securities compensation and settlement, Cecabank is situated as the great national depositary regardless of collective investment institutions, pension funds, EPSV and companies of venture capital, as well as leading provider in settlement and custody services.

At the close of 2023, the volume of deposited assets of the more than 40 managers clients of Cecabank ascended to more than 224,000 million euros, distributed in nearly 1,000 vehicles of investment and saving. With respect to the total volume of assets guarded, remains as a benchmark company, the 100 financial institutions of all type to those which the bank provides services have reached a total of 310,000 million euros in assets guarded.

In a financial outlook characterised by the boom of the criptoactivos and the sustainable transition, Cecabank assumes these realities as essential businesses that explore to accompany to its clients. In this line, last year, the Banco de España selected to the consortium formed by Cecabank and ABANCA Banking Corporation to initiate the programme of experimentation in which will be used tokens digital for the settlement of fee-paying operations and of wholesale securities. This test will allow knowing inherent advantages and disadvantages that would have the use of a digital euro wholesaler in interbank operations. In addition, with the aim of accompanying to its clients in its effort for including criteria ASG in its activity, Cecabank provided them the share in more than 3,500 meetings in 73 countries distributed by the five continents and it sent to market more than 12,000 instructions of vote in a satisfactory way via its service of Proxy Voting.

We must emphasise also that the company went designated as depositary company of three out of the five managing entities selected tenderers for the management of the pension funds of public promotion employment for a maximum five-year period.

On the other hand, Cecabank, as hub national and international of Payments, offers flexible and innovative solutions for the processing of payments by card, e-commerce and payment with the mobile phone, guaranteed by more than 30 years of experience. Throughout 2023, the bank has processed more than 1,450 million transactions with cards and more than 800 million operations with account, including 156 million transactions Bizum from client to client.

In line with its steady commitment with the innovation, the bank has moved forward significantly in the implementation of new functionalities to provide the immediate payments both between people and in businesses. And, in the field of cards, during 2023, Cecabank has developed new products in the environment of adquirencia in businesses in person and e-commerce, and it has begun to process ATMs in Portugal.

When it comes to the business of Cash Management, and despite the marked complex stage for the tightening of the monetary policy and the volatility of the geopolitical environment, the company has achieved exceed the set objectives for the financial margin, while it has maintained a cash position comfortable and solvency.

Cecabank carries out operations in the main national markets and international of fixed income (public and private), currencies, equities and derivatives; in the sector of FX, is one of the actors principals on the market national. The company is direct member of the Central Counterparties and market maker principals of public debt, NextGeneration EU and, from 2022, in futures in organised markets of the product xRolling FX. In addition, as the creators of the public bond market for the Spanish Treasury, in 2023 the bank took part in a total of 10 Next Generation EU syndicated issues and four Spanish Treasury issues as co-lead, also participating in the contracting of MREL-eligible deposits with fourteen banks.