P.

19

2018 Pillar 3 Disclosures

Capital

3 |

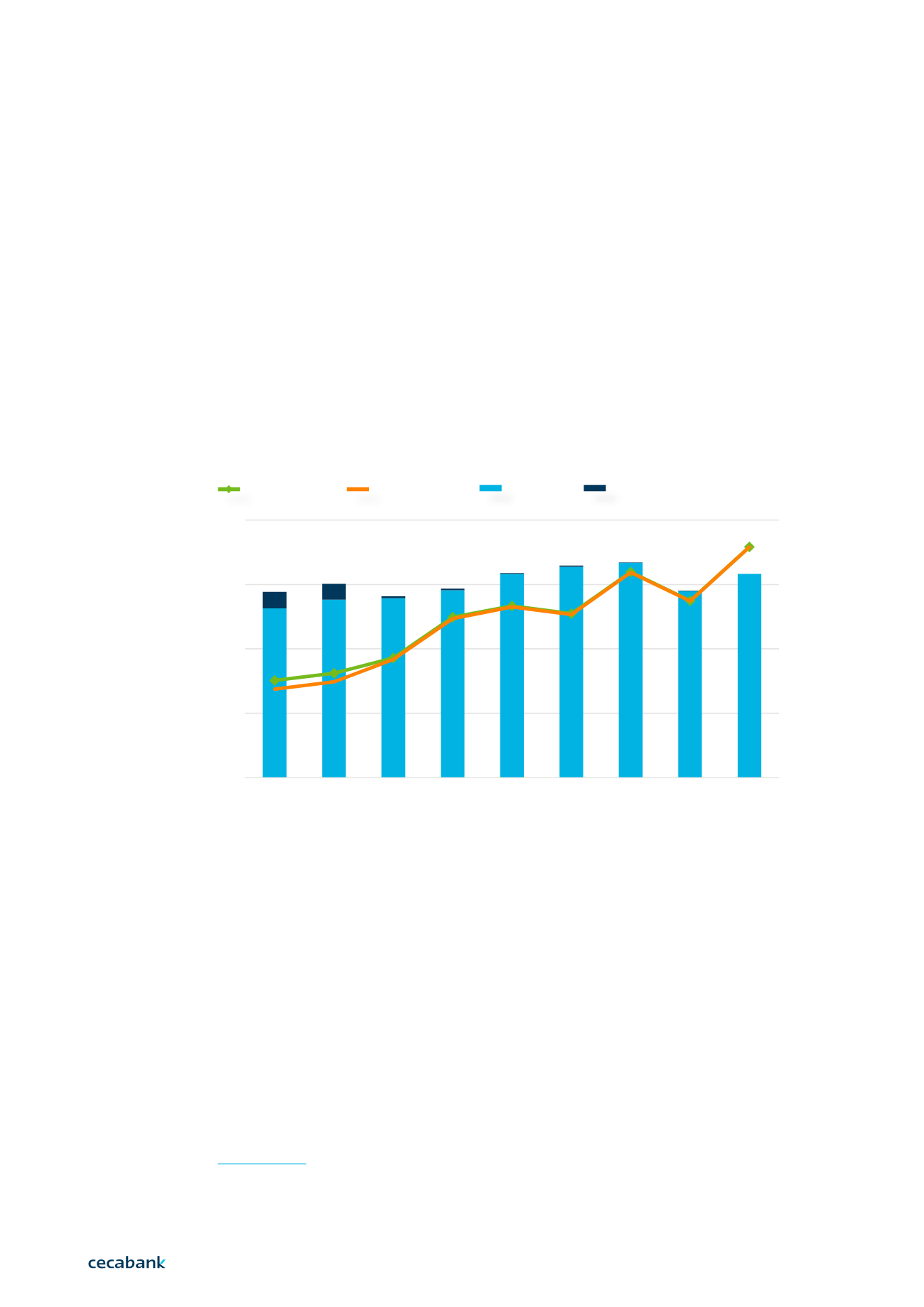

At the 2018 year-end, the solvency ratio

3

of Cecabank was 35.83%, fully comprising Common

Equity Tier 1 capital (CET1), i.e. the CET1 solvency ratio was also 35.83%. The main factor that

has conditioned the progress of these ratios has been the decrease in weighted exposure for

credit and counterparty risk, both general and securitisation.

A key factor for management is keeping a sound capital structure in terms of quantity and

quality. As a result, and as reflected in the graph, in recent years, the Tier 1 capital base has

been progressively strengthened through the capitalisation of profit which, together with the

maintenance of low risk levels, has enabled a sustained improvement of the capital ratios

over time.

In 2018, the Board of Cecabank has maintained a minimum capital ratio of 14%. This ratio is

established in terms of Common Equity Tier 1 capital. In addition, the Risk Tolerance Framework

establishes a margin of leeway for this ratio above which the bank must operate under normal

circumstances. Both levels are amply surpassed at present.

This comfortable solvency situation allows Cecabank to cover current and future capital

requirements, and those deriving from additional risks considered when self-assessing capital,

that are not included in Basel Pillar 1 requirements.

Similarly, on 21 December 2018, the Bank of Spain informed Cecabank, S.A. of the decision

on capital taken as a result of the bank’s risk supervision assessment process. As a result of

this process, the Bank of Spain set a required CET1 solvency ratio of 10.23%, which includes

all concepts of risk, a ratio that coincides with that calculated by the bank in its internal

capital adequacy assessment for the year 2017. At the end of the financial year, the own funds

classified as CET1 covered this requirement with an excess of 250%.

3 As in 2017, the own funds at 2018 year-end do not reflect the year’s results that the Board of Directors

agreed to withhold as reserves for an amount of €42.5 million. If it had been the case, the solvency ration

and the CET1 solvency ration would stand at 37.76%.

40%

30%

20%

10%

0%

2010 2011 2012 2013 2014 2015 2016 2017 2018

1,000

750

500

250

0

Total Capital Ratio

Tier 1 Capital Ratio

Tier 1 Capital

Tier 2 Capital

Millon euros