P.

25

2018 Pillar 3 Disclosures

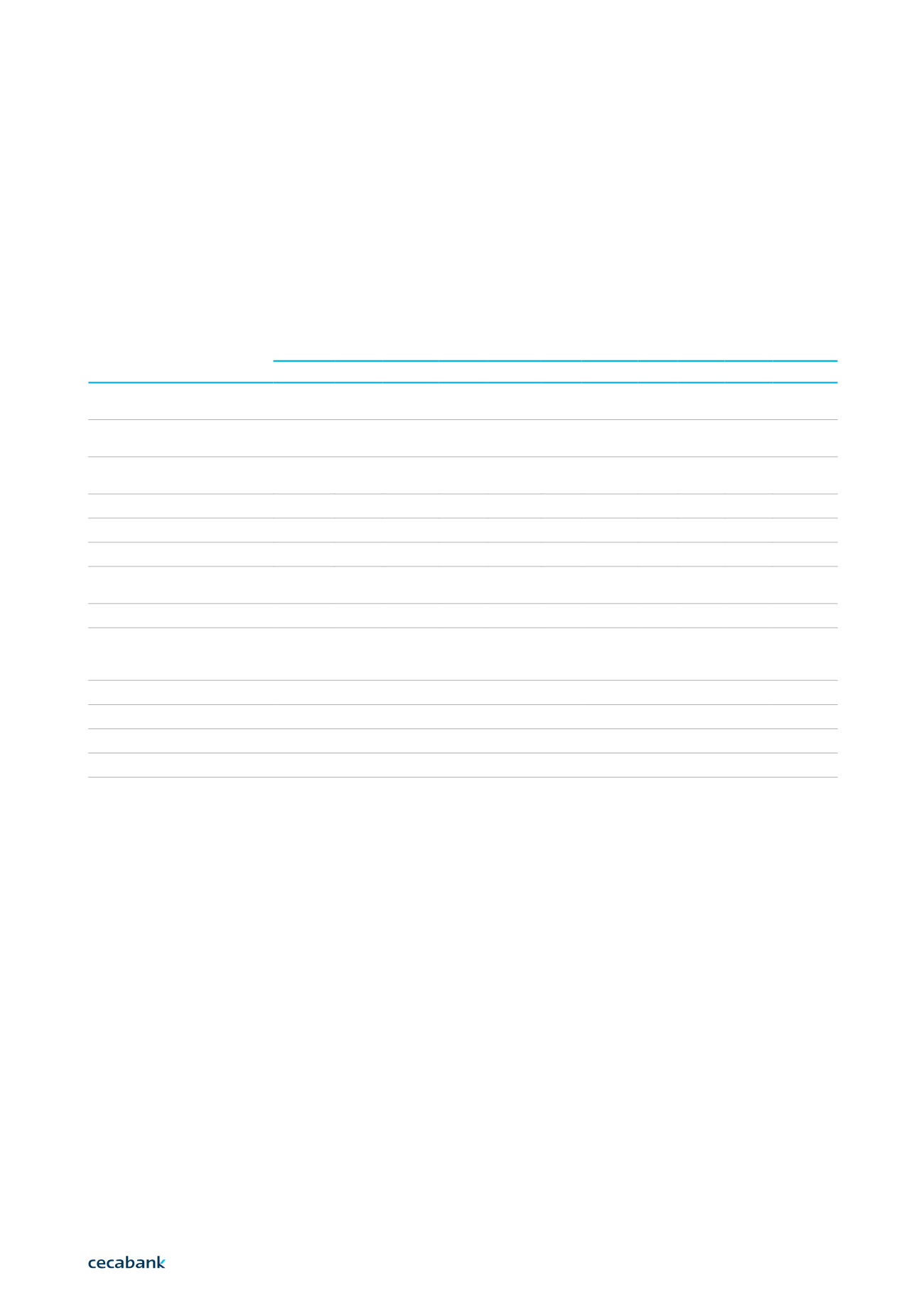

Capital

Risk Category

Exposure classified by the applied risk weight, according

to the degree of credit quality of each exposure

0% 2% 20% 35% 50% 75% 100% 150% 250% Otras

Total

Central administrations or

central banks

4,068,854

0

0

0

0

0 28,291

0 54,014

0 4,151,159

Regional administrations and

local authorities

368,897

0

0

0

0

0

0

0

0

0 368,897

Public sector entities and other

non-profit public institutions

2,757

0

0

0 10,218

0

0

0

0

0 12,975

Institutions

0

0 594,107

0 207,819

0 33,465

0

0

0 835,391

Corporates

0 93,716

1

0 15,444

0 262,313 2,998

0 22,659 397,131

Retail

0

0

0

0

0 8,398

0

0

0

0

8,398

Exposures secured by mortgages

on immovable property

0

0

0 41,739

0

0

0

0

0

0 41,739

Exposures in default

0

0

0

0

0

0

630 269

0

0

899

Exposure to institutions and

corporates with a short-term

credit assessment

0

0

0

0

4

0

0

0

0

0

4

Equity exposures

0

0

0

0

0

0 11,627

0

0

0 11,627

Other exposures

119,016

0

0

0

0

0 53,947

0

0

0 172,963

Securitisation exposures

0

0

0

0 34,188

0

0

0

0 1,952 36,140

Total

4,559,524 93,716 594,108 41,739 267,673 8,398 390,273 3,267 54,014 24,611 6,037,323

Thousands of euros.

3 | 3.2

The distribution of the fully-adjusted exposure according to the weighting by corresponding risk is

shown in the following table: