P.

41

2018 Pillar 3 Disclosures

Credit and dilution risks

At year-end 2018, there were no credit derivatives used as a credit-risk reduction technique.

Central Clearing Houses and Organised Markets

The bank settles and clears OTC derivatives in central counterparty clearing houses, as required

by the regulations. It also clears and settles part of its repo and sell/buy-back operations in this

type of counterparty to mitigate credit risk.

OTC derivatives operations are carried out indirectly through a clearing member.

Repo and sell/buy-back activity is cleared and settled directly by the bank in various houses,

being a clearing member.

With regard to organised markets, the bank carries out operations directly with central

counterparty clearing houses on national markets and indirectly in international markets through

a clearing member..

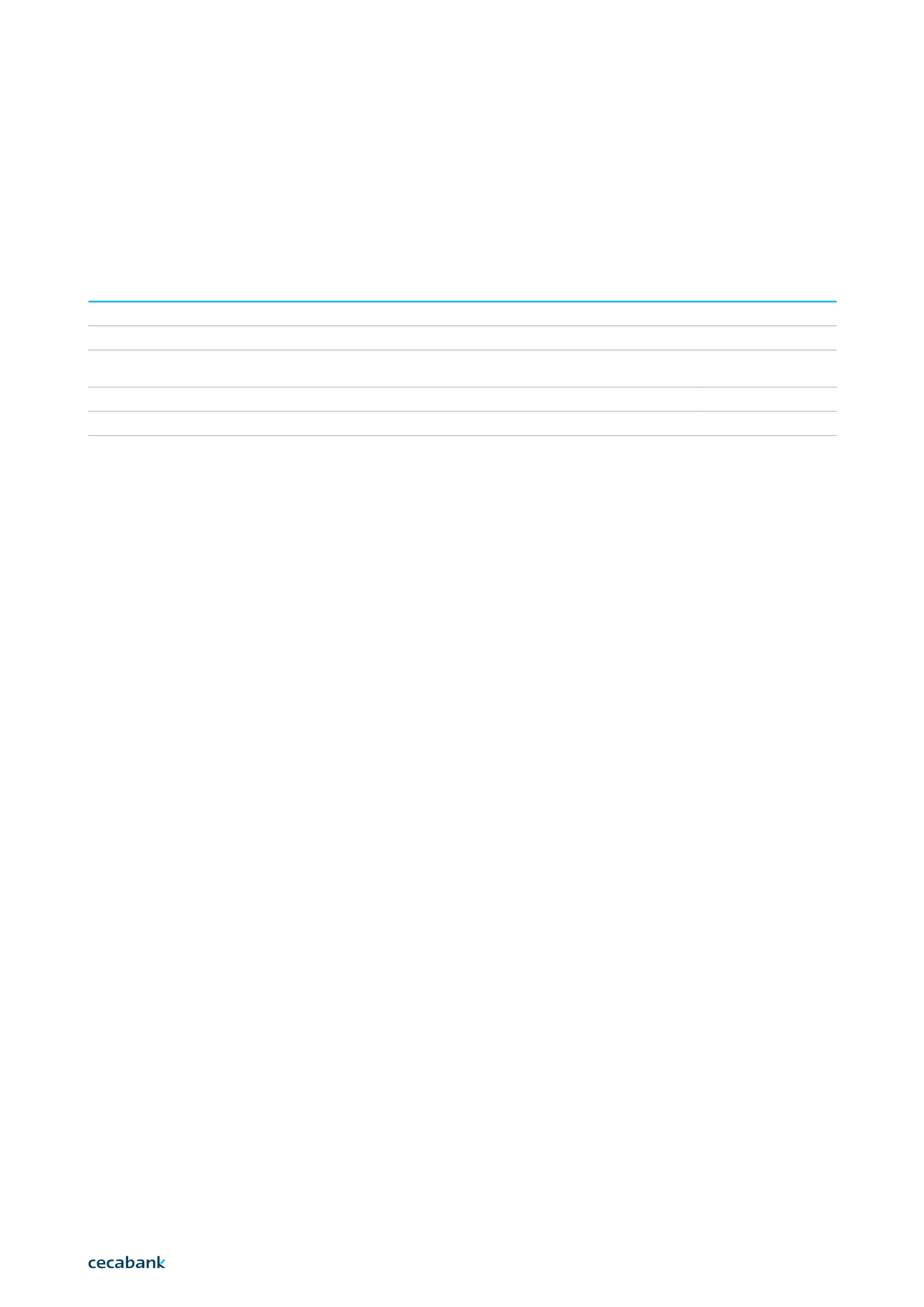

4 | 4.10

Exposure type

Value of the

original exposure

A) Exposures to which no credit-risk mitigation technique is applied

6,023,467

B) Exposures to which a credit-risk mitigation technique is applied

198,484

- Netting master agreements regarding operations with a repurchase commitment, securities or

commodities lending operations or other operations tied to the capital market

189,705

- Collateral

0

- Hedging based on personal guarantees

8,779

Datos en miles de euros