P.

45

2018 Pillar 3 Disclosures

Market risk in the trading book

For the purposes of calculating the capital requirements associated with the trading book, it

should be indicated that the bank classifies as such any positions in financial instruments and

commodities which are held with the intention of trading, in other words, the portfolio of

financial assets held for trading (“intention of trading” being understood as holding positions

for the purpose of disposing of them in the short term or benefiting in the short term from real

or expected differences between the purchase price and the sale price, or variations in other

prices or interest rates), or which are measured at fair value through profit or loss (portfolio

of financial assets not held for trading at fair value through profit or loss). Finally, the trading

book includes positions that provide coverage to the elements of this portfolio.

The bank uses an internal model for managing and controlling market risk. It also uses this

model to determine the capital adequacy of the capital requirement established according

to the standard methodology, if it is necessary to take any type of action through Pillar 2. A

description of the risk management and control model can be found in point 2 of Annex I.

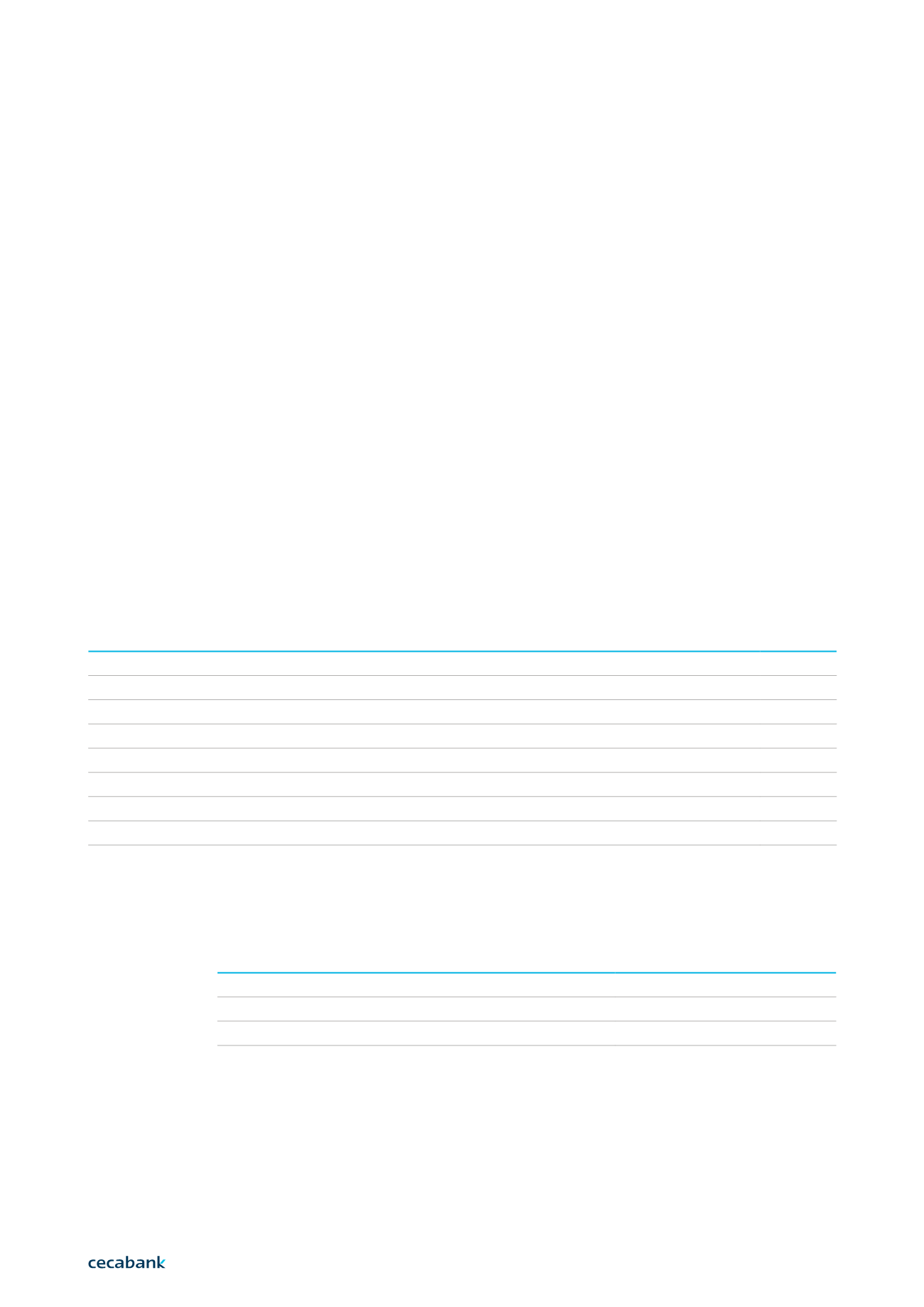

The details of financial assets included in the trading book are set out below as defined

previously, classified by accounting portfolio and type of instrument at 31 December 2018.

This classification includes the changes introduced by IFRS 9 regarding asset valuation and

classification, set out at the end of this section.

The table below shows the amount of capital requirements associated with the trading book at 31

December 2018:

Capital requirements in the trading book

Position risk requirements

59,826

Counterparty credit risk requirements

6,709

Total capital requirements

66,535

Thousands of euros.

5 |

Financial assets for trading

Held-for-trading financial assets

1,920,383

Derivatives

926,943

Equity instruments

240,744

Debt securities

752,696

Financial assets not held for trading at fair value through profit or loss

60,413

Equity instruments

19,093

Debt securities

41,320

Total financial assets in the trading book

1,980,796

Thousands of euros.