P.

46

2018 Pillar 3 Disclosures

Market risk in the trading book

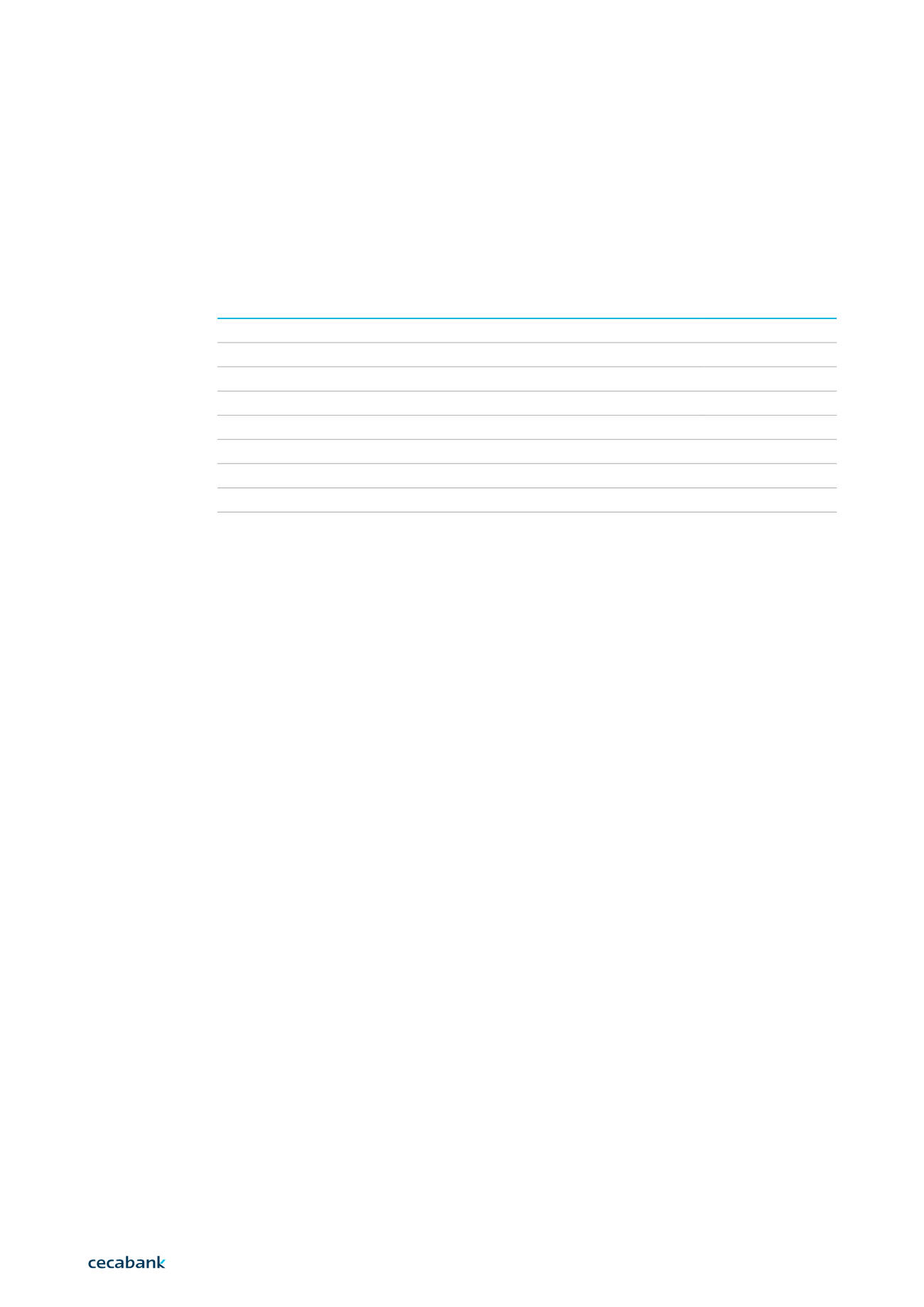

Details of capital requirements for position risk, according to the instrument, are as follows:

Position risk requirements

Requirements for position risk in equity instruments

8,764

General Risk

1,446

Specific Risk

7,318

Requirements for position risk in fixed-income instruments

51,062

General Risk

45,958

Specific Risk

5,104

Own funds requirements for securitisation instruments

941

Total capital requirements

59,826

Thousands of euros.

As mentioned previously, within the positions of the trading book fixed-income portfolio, there

are securitisation positions with capital consumption requirements of €941,000.

The standard for recognition and measurement of financial instruments IFRS 9 entered into force

on 1 January 2018. On the basis of this standard, the necessary accounting adjustments have

been carried out to show a correct classification and valuation of the assets based on the bank’s

business model. The result has been: the transfer of certain equity and debt instruments classified

in the “Financial assets measured at fair value through changes in other comprehensive income”

portfolio to the new portfolio of “Assets not held for trading measured at fair value through profit

or loss”, and in the transfer of other debt instruments of the “Financial assets at amortised cost”

portfolio (which were fully provisioned) to the portfolio of “Assets not held for trading measured

at fair value through profit or loss.” The details of these transfers can be found in Note 1.4 of the

report of the Group to which Cecabank belongs.

5|