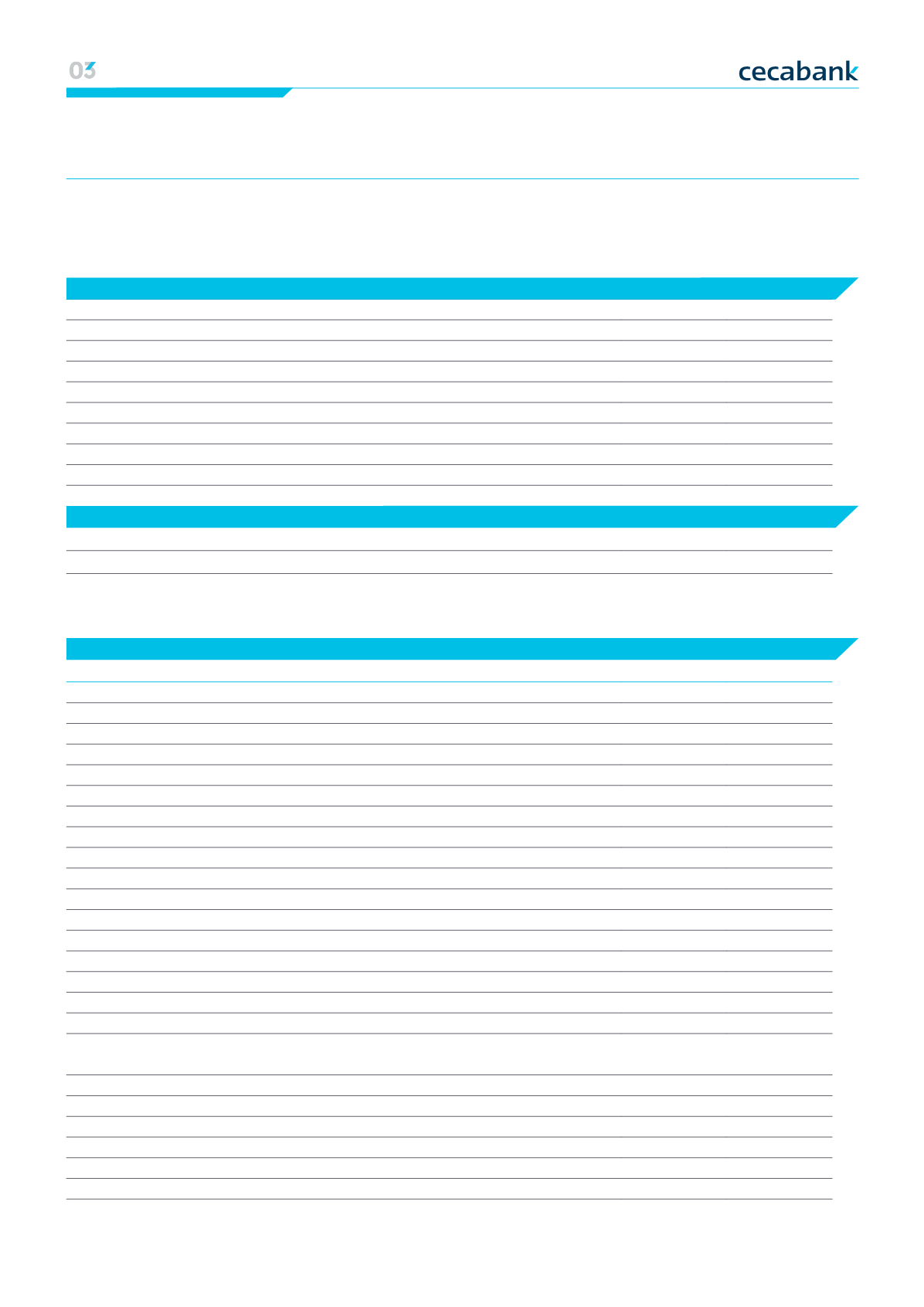

71

Annual Report 2014 Our Business ModelMemorandum item: Acquired under a finance lease

-

-

14. Intangible asset

39,264

55,854

14.1. Goodwill

-

-

14.2. Other intangible assets (Note 13)

39,264

55,854

15. Tax assets

124,116

119,807

15.1. Current

226

498

15.2. Deferred (Note 20)

123,890

119,309

16. Other assets (Note 14)

31,685

18,984

TOTAL ASSETS

10,862,998 12,061,106

Assets

2014

2013 (*)

Memorandum entry

2014

2013 (*)

1. Contingent exposures (Note 27.1)

72,750

58,202

2. Contingent commitments (Note 27.3)

724,862

623,477

LIABILITIES

1. Trading book (Note 6.1)

2,267,416

3,963,813

1.1. Deposits from central banks

-

-

1.2. Deposits from credit institutions

-

-

1.3. Customer deposits

-

-

1.4. Marketable debt securities

-

-

1.5. Trading derivatives

1,661,534

3,412,526

1.6. Short positions

605,882

551,287

1.7. Other financial liabilities

-

-

2. Other financial liabilities at fair value through profit and loss (Note 6.2)

1,365,643

1,657,148

2.1. Deposits from central banks

-

-

2.2. Deposits from credit institutions

692,386

1,005,963

2.3. Customer deposits

673,257

651,185

2.4. Marketable debt securities

-

-

2.5. Subordinated liabilities

-

-

2.6. Other financial liabilities

-

-

3. Financial liabilities at amortised cost (Note 15)

5,941,940

5,161,572

3.1. Deposits from central banks

-

1,319,356

3.2. Deposits from credit institutions

1,532,528

1,206,249

3.3. Customer deposits

3,922,701

2,363,082

3.4. Marketable debt securities

-

-

3.5. Subordinated liabilities

-

-

3.6. Other financial liabilities

486,711

272,885

4. Value adjustments to macro-hedged financial liabilities

-

-

5. Hedging derivatives (Note 9)

6,073

9,364

6. Liabilities associated with non-current assets held for sale

-

-

Liabilities and Equity

2014

2013 (*)

00 Strategic lines |Economic and regulatory context | Strengthening our model

|

Business lines 01 Financial information|

Profit & loss | Activity|

Capital base | Ratings 02 Risk management | The Cecabank risk function