73

Annual Report 2014 Our Business ModelRatings awarded to Cecabank

as at 31 December 2014 by

the international agencies Fitch

Ratings, Moody’s and Standard &

Poor’s, are:

Agency Short-term Long-term Outlook

Date

Moody´s

NP

Ba3

Negative

20/11/2014

Fitch

F3

BBB-

Negative

21/11/2014

S&P

A-2

BBB

Stable

27/11/2014

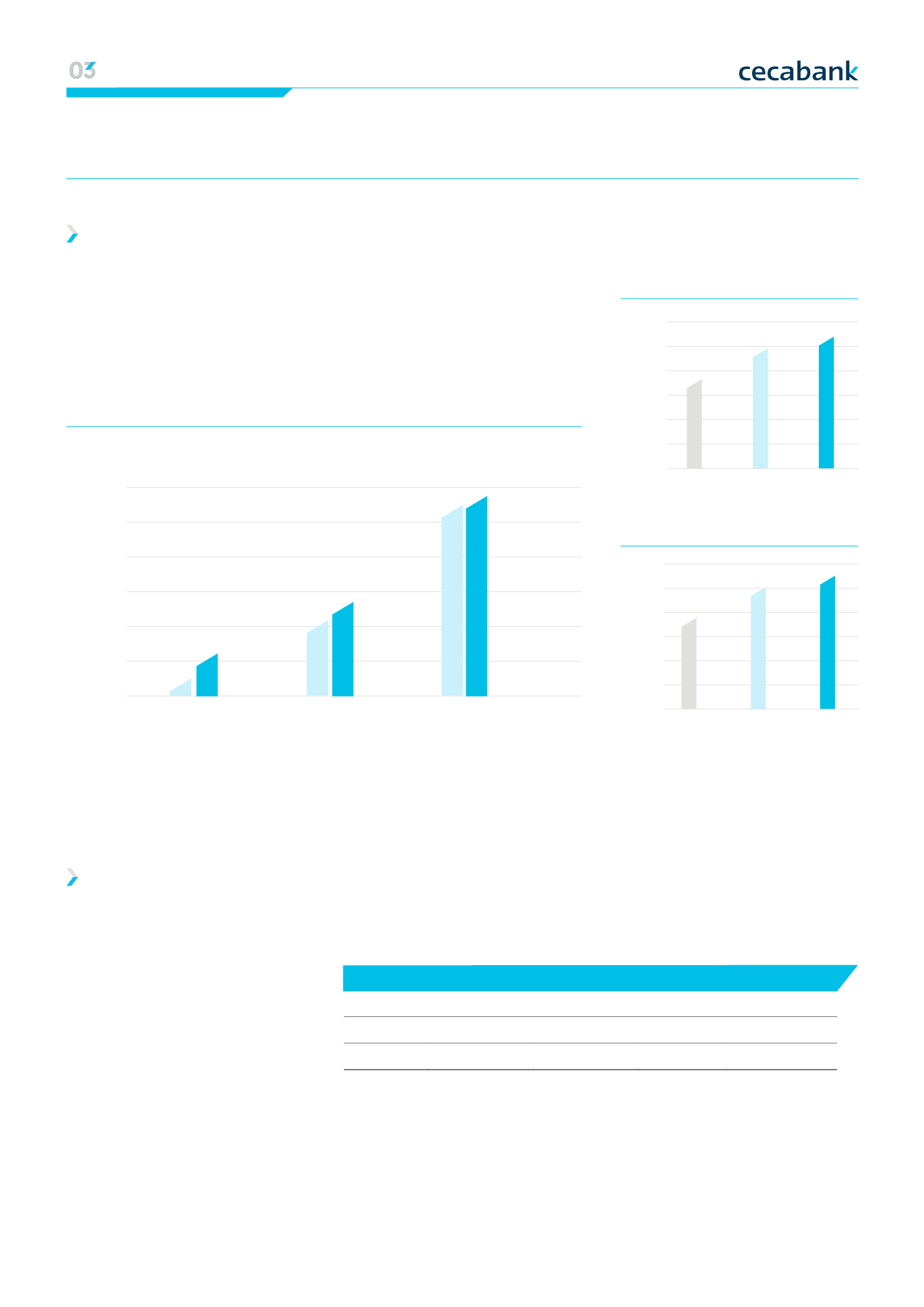

Cecabank has been strengthening its capital base in recent years, which in

conjunction with low levels of risk, has enabled its capital ratios to increase

steadily over time.

2012

700000

740000

780000

800000

760000

720000

680000

2013

2014

TIER 1 CAPITAL

791,021

695,991

727,554

794,896

704,640

734,265

thousands of euros

Tier 1 capital

Total equity

Capital base

Ratings

2012

5,00%

15,00%

25,00%

30,00%

20,00%

10,00%

0,00%

2013

2014

CET 1 RATIO

26.53%

18.36%

24.71%

5,00%

15,00%

25,00%

30,00%

20,00%

10,00%

0,00%

SOLVENCY RATIO

2012

2013

2014

26.66%

18.59%

24.94%

00 Strategic lines | Economic and regulatory context | Strengthening our model|

Business lines 01 Financial information | Profit & loss | Activity | Capital base | Ratings 02 Risk management | The Cecabank risk function