General

Shareholders Meeting

76

Annual Report 2014 Our Business ModelStructure and Organisation

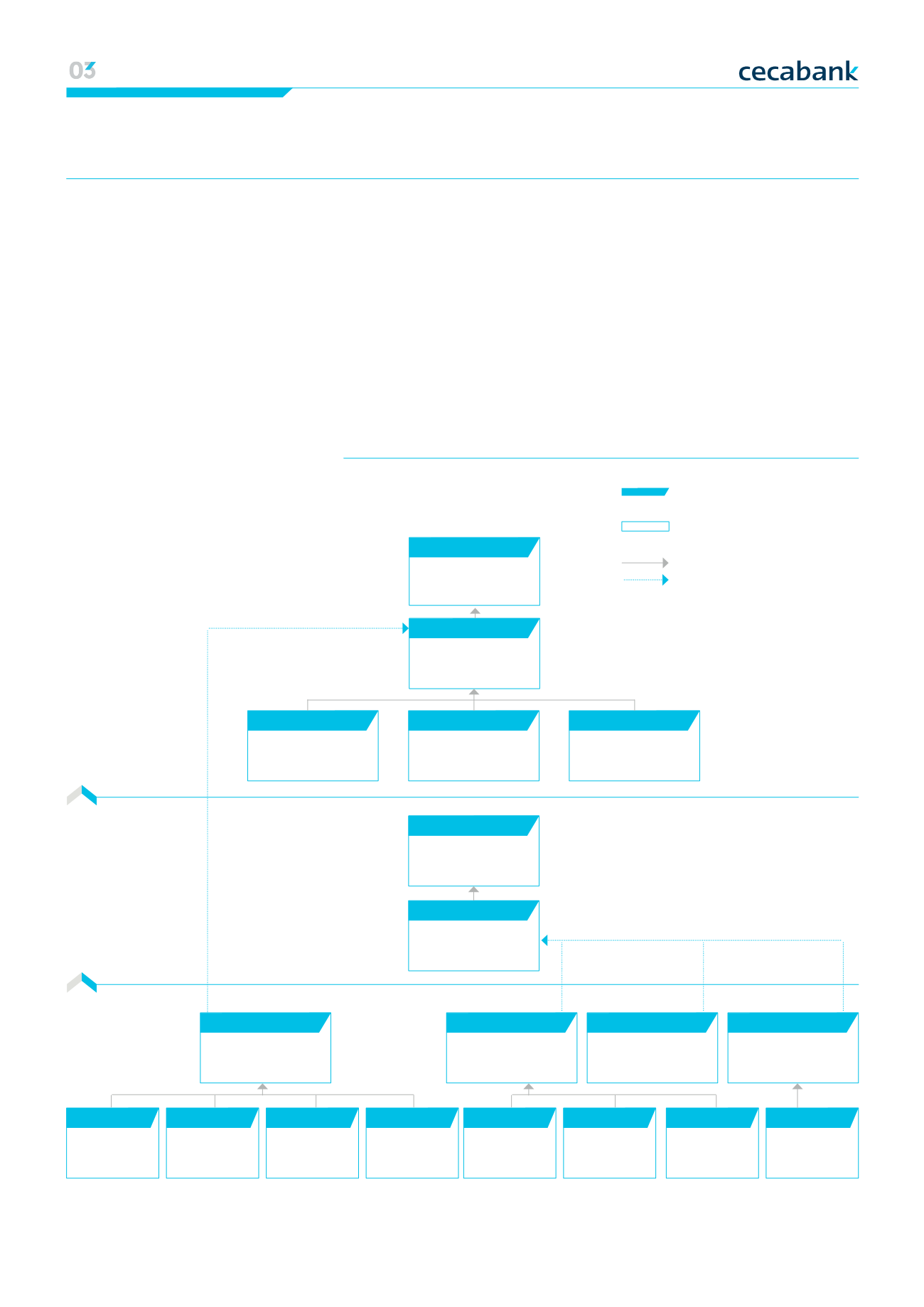

MAIN BODIES

FROM THE VIEWPOINT OF RISK MANAGEMENT

Board of Directors

Solvency and

Liquidity Committee

Audit Committee

Chief

Executive Officer

Management

Committee

Assets and Liabilities

Committee

Compliance

Committee

Global Security

Committee

Operational Risk

Committee

Appointments and

Remuneration

Committee

Risks

Committee

New Products

Committee

Market Code

of Conduct

Committee

Data

Protection

Committee

Financial

Committee

Liquidity

Contingency

Committee

Anti-Money

Laundering

Committee

OperationalRisk

Identification

Committee

Hierarchical dependency

Reporting line

Structure and organisation of the

risk-management function

Risk-management strategy

and processes

Cecabank’s Board of Directors is the

body deciding the institution’s risk

policy. It delegates its functions to

senior management, which

provides support on the various

functions through the Assets and

Liabilities Committee (COAP), the

Operational Risk Committee and

Compliance Committee.

00 Strategic lines | Economic and regulatory context | Strengthening our model|

Business lines 01 Financial information | Profit & loss | Activity|

Capital base | Ratings 02 Risk management | The Cecabank risk function