39

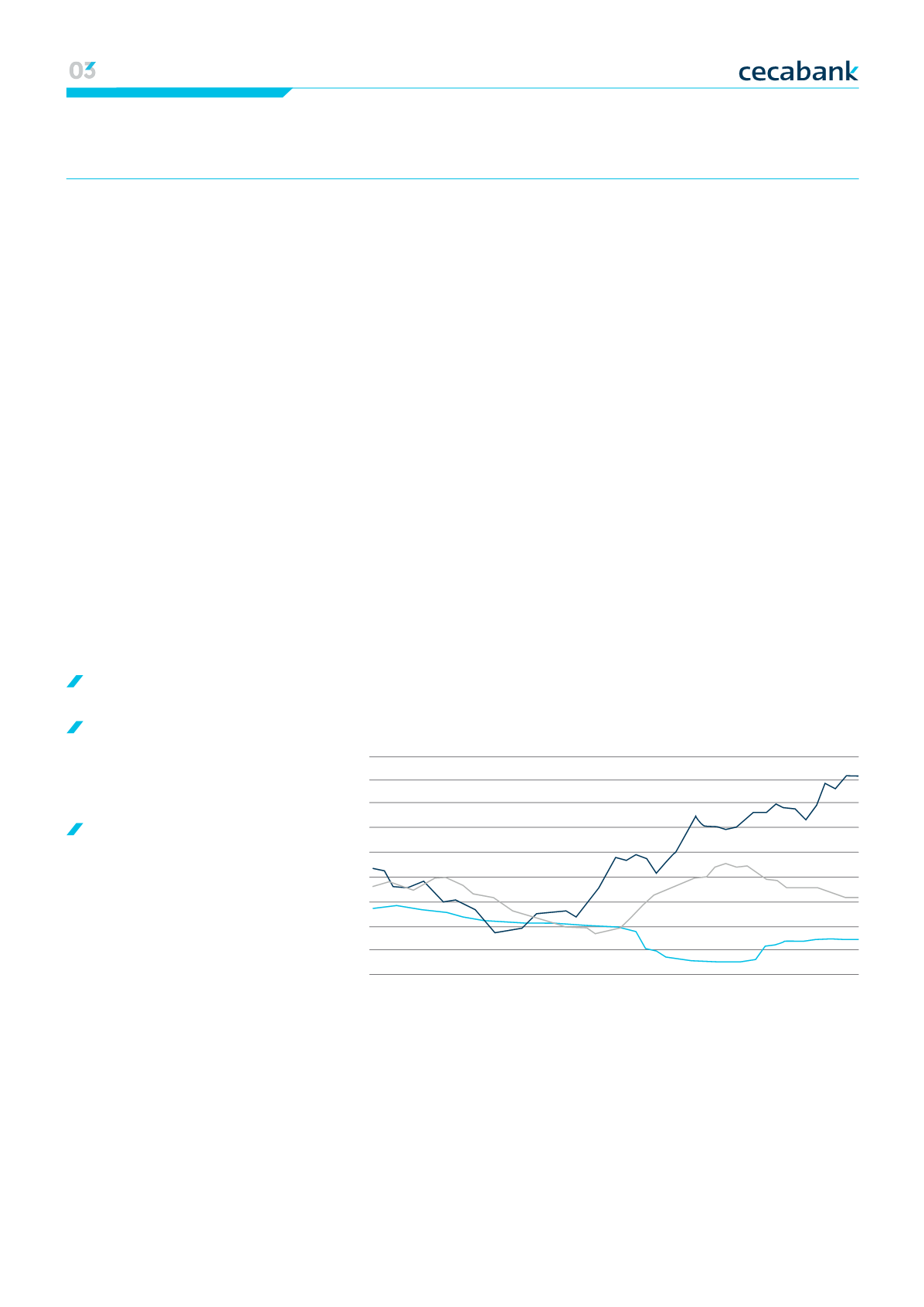

Interest rates in the main economiess

PRIVATE

SECTOR DEPOSITS

PRIVATE

SECTOR CREDIT

OFF BALANCE SHEET

RESOURCES

9

10

9

11

9

12

9

13

9

14

11

11

11

11

1

1

1

1

3

3

3

3

5

5

5

5

7

7

7

7

25

30

20

15

10

-5

5

-10

0

-15

Over the course of 2014

credit

to the private sector

continued

its contractionary trend among

deposit-taking institutions as

a whole, registering a year-on-

year drop of close to 8 percent in

September. A slight upturn in flows

of new credit has been detected,

particularly among households

and SMEs, although it is still

insufficient to offset the volume

of repayments, resulting from the

deleveraging underway in the

private sector.

All this reflects:

Better conditions in the

financial markets;

A context of lower interest

rates, which has influenced

economic agents’ decisions

about the form in which to

hold their savings;

Institutions’ marketing

strategies, making products

such as deposits less

attractive, such that they

moderated their growth

to a rate of 1 percent in

September, in favour

of off-balance sheet products,

and investment funds

in particular.

In the case of the latter, according

to data published by INVERCO,

in 2014 the boom in investment

funds intensified, reaching a

level of assets of 188,626 million

in September, an increase of

23 percent during the year.

The cumulative volume of net

subscriptions since January

is close to 30 billion, only

exceeded by those in the same

period in 1997.

Our Business Model Annual Report 2014 00 Strategic lines | Economic and regulatory context | Strengthening our model |Business lines 01 Financial information | Profit & loss

|

Activity |Capital base |

Ratings 02 Risk management | The Cecabank risk function