41

BANKING UNION

It comprises three main pillars:

The Single Supervisory

Mechanism (SSM

);

The Single Resolution

Mechanism (SRM);

A Europe-wide deposit

guarantee fund.

Supported by the

“single rulebook”

which aims to standardise EU rules

on financial matters.

Banking Union is a decisive step

towards building a single European market

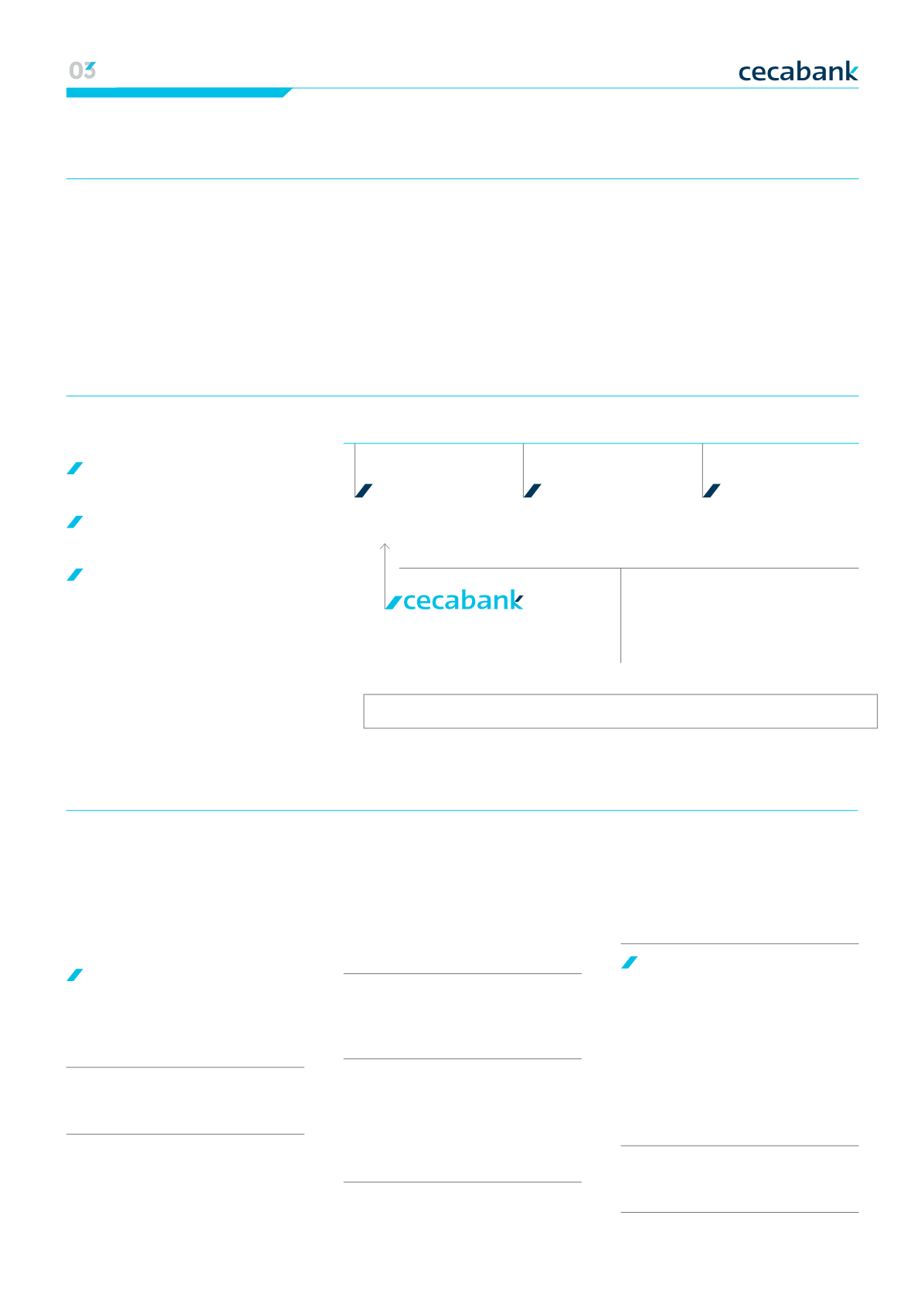

BANKING UNION - PILLARS

Common rules

EBA - Single Rulebook

SSM

Direct supervision of

significant institutions

SRM

Single Supervisory

Mechanism

DGF

Deposit

Guarantee Fund

Indirectly supervised

by the ECB through the SSM

The Single Supervisory Mechanism

Based on the ECB’s assuming

supervisory competences over all

euro area credit institutions. Came

into operation on 4 November 2014.

The SSM operates on two levels:

Direct supervision

of significant institutions,

namely those meeting one or

more of the following criteria

(120 institutions):

Total consolidated assets exceed

30

billion euros

The ratio of the institution’s assets

to GDP of the country in which it is

based exceeds

20%

of national GDP

unless its total consolidated assets

are less than 5 billion euros.

It is one of the

3

largest institutions

in the Member State

It has subsidiaries in more than one

participating country, whose assets

or cross-border liabilities represent

more than

20%

of total assets or liabilities

It has received or applied for direct

Financial support

from the European Financial

Stability Facility or the European

Stability Mechanism.

Indirect supervision

other financial institutions (over

3,000), supported by the work of na-

tional supervisors, but subject to the

application of standardised policies

and procedures, such that the ECB

maintains ultimate responsibility,

and the option of assuming direct

supervision of specific institutions if it

sees fit.

More than

3,000

financial institutions

SSM

Our Business Model Annual Report 2014 00 Strategic lines | Economic and regulatory context | Strengthening our model|

Business lines 01 Financial information | Profit & loss | Activity|

Capital base | Ratings 02 Risk management | The Cecabank risk function