38

Our Business ModelEconomic

recovery in 2015

The Spanish economy’s recovery

is set to gain traction in 2015,

supported by various factors

that are more or less transitory,

but which will last for some time:

the sharp drop in interest rates

resulting from the ECB’s new

measures, which will intensify

with the new debt-purchase

programme, whereby the ECB

will buy 60 billion euros of

debt a month until September

2016; cheaper oil, which on

the demand side represents

increased disposable income for

consumers, while on the supply

side it represents lower production

costs; the cut in personal income

tax, combined with a more

expansionary course to public

spending; and finally, the euro’s

depreciation against the dollar,

although this factor’s impact on

exports and GDP

will be modest.

Nevertheless, constraints

on growth persist and it should

not be forgotten that Spain

remains highly vulnerable to

changing perceptions in the

financial markets.

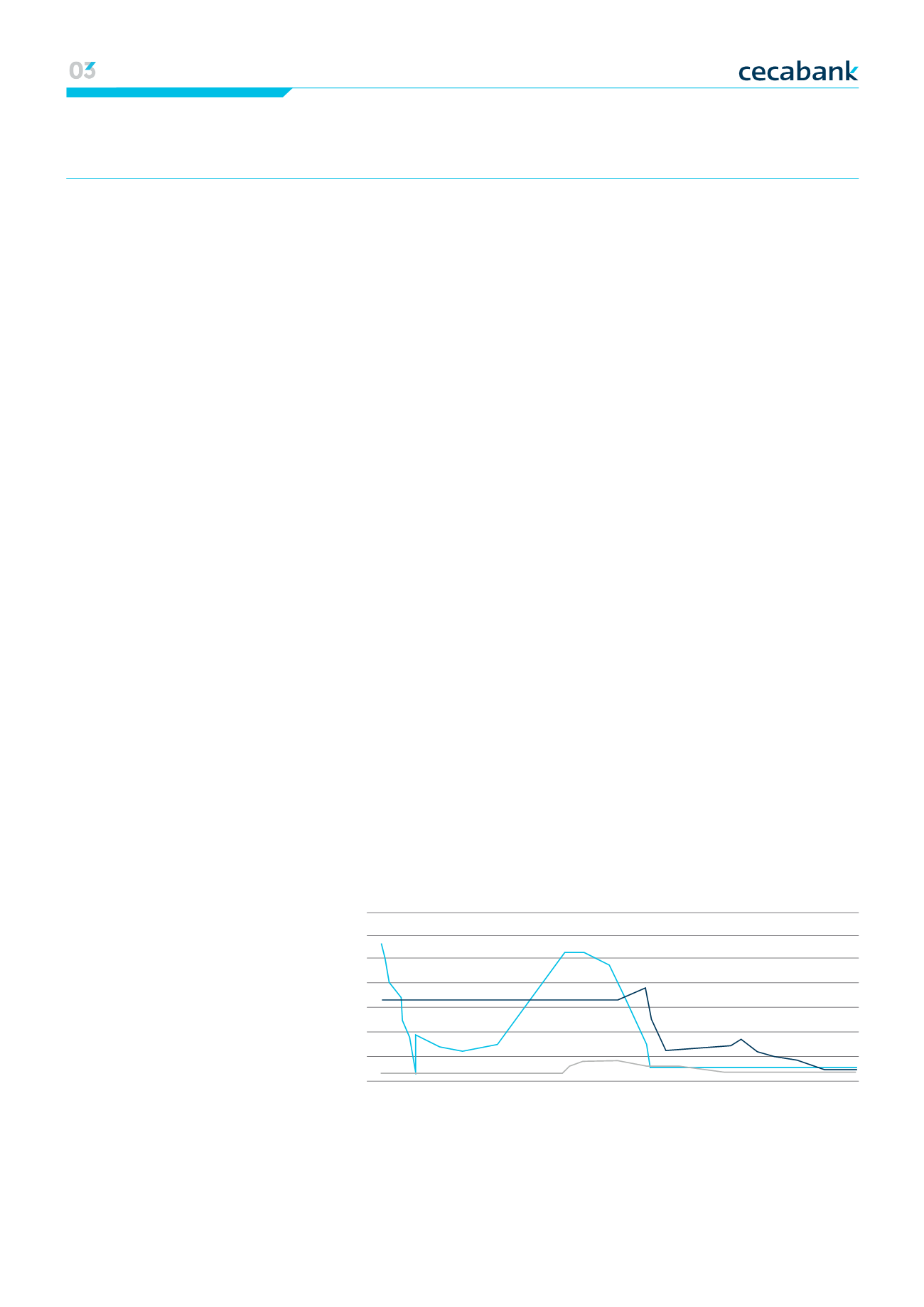

Interest rates in the main economies

04-02-2001

04-02-2006

04-02-2011

04-08-2003

04-08-2008

04-08-2013

04-05-2002

04-05-2007

04-05-2012

04-11-2004

04-11-2009

04-11-2014

5

6

7

4

3

2

1

0

JAPAN

USA

EURO AREA

World

economic

growth in 2014

and 2015 will be led by the United

States, with moderate progress

in Japan and the Euro area, and

Spain’s economy posting the

fastest growth among the main

euro area economies in 2015.

Thus, Funcas estimates Spanish

GDP growth at 2.4 percent, two

percentage points higher than in

previous forecasts.

Trend in interest rates and

retail banking activity

Interest rates

are at historic lows

as a result of expansionary policies

in the context of a recession in

the global economy. Against

this backdrop there is much

speculation about the risks of the

“Japanification” of the European

economy, which would mean a long

period of slow growth with zero or

low inflation, or even deflation.

This leads to a narrowing of retail

institutions’ financial margin,

which also has repercussions

for customers.

Negative short-term interest rates

mean customers have difficulty

earning a yield on their deposits,

increasing demand for off-balance

sheet products.

For banks it means lower profits

on their portfolio, weakening

financial margins.

Persistence of low

interest rates.

Annual Report 2014 00 Strategic lines | Economic and regulatory context | Strengthening our model|

Business lines 01 Financial information | Profit & loss|

Activity|

Capital base|

Ratings 02 Risk management | The Cecabank risk function