40

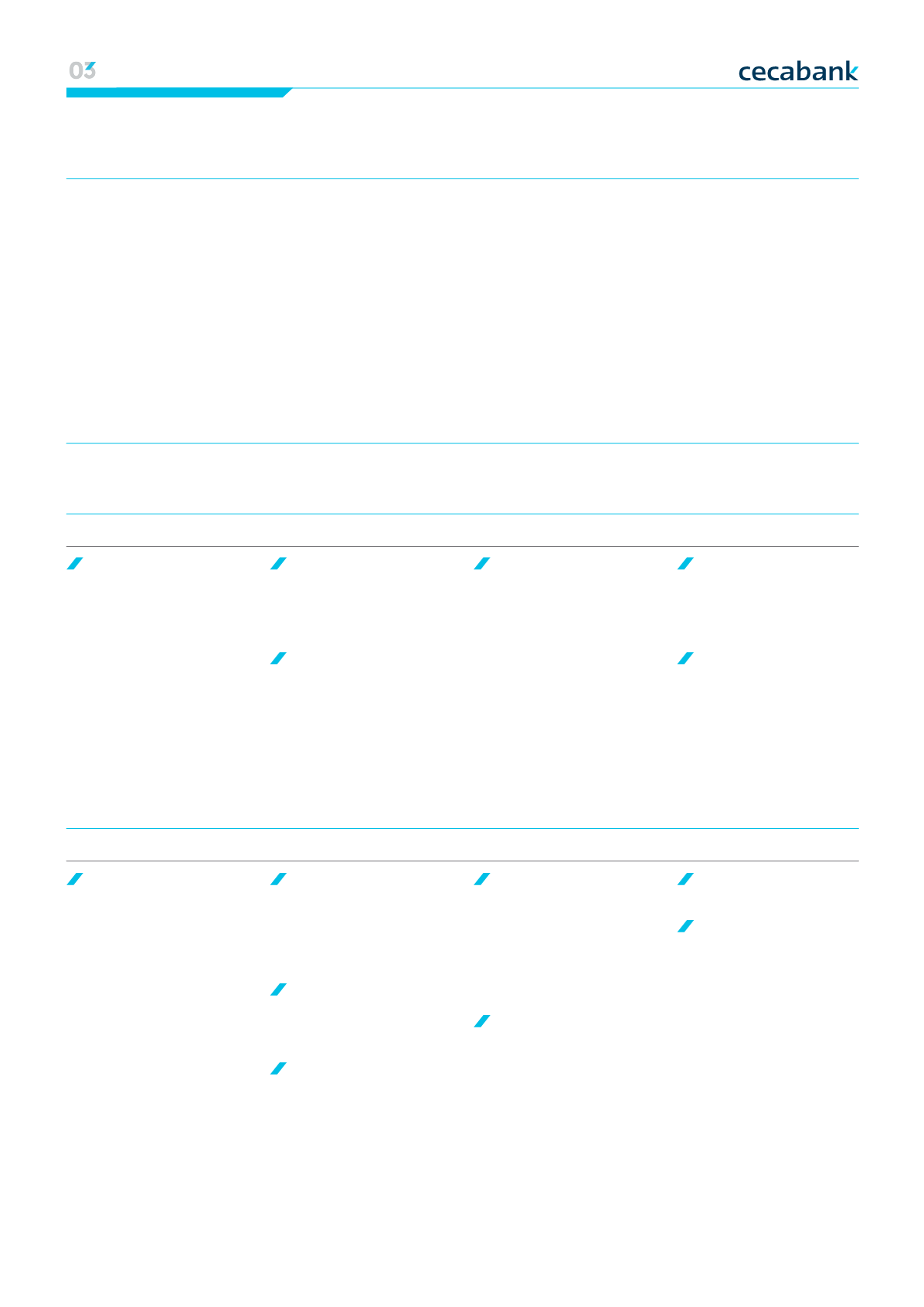

Regulatory environment

NATIONAL

1T

Bank of Spain Circular

44/2014, on public and

confidential financial

reporting rules, and

standard formats for

financial statements.

2T

Law 10/2014

of 26 June 2014

on the regulation,

supervision and solvency

of credit institutions.

Royal Decree 304/2014,

enacting the Regulation

on the prevention of

money laundering and

terrorist financing.

3T

Law 17/2014, on

urgent measures on the

subject of refinancing

and restructuring of

business debt.

4T

Law 31/2014

amending the Share

Capital Companies

Law to improve

corporate governance.

Law 22/2014,

regulating venture

capital firms, other

collective investment

undertakings of the

closed-ended type, and

management firms for

collective investment

undertakings of the

closed-ended type.

INTERNATIONAL

1T

Directive 2014/17/EU

on credit agreements

for consumers

relating to residential

immovable property.

2T

Directive 2014/59/

EU establishing a

framework for the

recovery and resolution

of credit institutions and

investment firms (BRRD).

Regulation (EU) No

600/2014 on markets

in financial instruments

(MiFIR).

Regulation (EU) No

468/2014 establishing

the framework for

cooperation within

the Single Supervisory

Mechanism.

3T

Directive 2014/92/EU

on the comparability of

fees related to payment

accounts, payment

account switching and

access to payment

accounts with basic

features (PAD).

Regulation (EU) No

806/2014 establishing

uniform rules and

a uniform procedure

for the resolution of

credit institutions and

certain investment

firms in the framework

of a Single Resolution

Mechanism and a Single

Resolution Fund.

4T

Publication of financial

institutions’ stress tests.

Regulation (EU)

2015/81 specifying

uniform conditions of

application of Regulation

(EU) No 806/2014

with regard to ex ante

contributions to the

Single Resolution Fund.

INSTITUTIONAL AGENDA

Main events in 2014

Our Business Model Annual Report 2014 00 Strategic lines | Economic and regulatory context | Strengthening our model|

Business lines 01 Financial information | Profit & loss | Activity|

Capital base | Ratings 02 Risk management | The Cecabank risk function